Why Electricity Prices Are Spiking — And How We Helped Nonprofits Navigate the Storm Together

In spring 2025, organizations across DC, Maryland, and Ohio found themselves facing unexpected news: a dramatic, across-the-board spike in electricity supply costs beginning in June. For budget-constrained nonprofits—schools, congregations, and community institutions alike—this presented more than a budget line adjustment. It became a source of uncertainty and concern at precisely the time of year when annual budgets are being finalized.

What caused this sudden increase? More importantly, what could we do about it?

Here is what happened in the electricity markets, why this was such a seismic shift, and how the Community Purchasing Alliance (CPA) organized and supported our members to make informed decisions—together.

Understanding What’s Behind Your Electricity Costs

If you’ve ever looked closely at your electricity supply rate, you’ll know it’s more than just the cost of electricity itself. Supply rates typically include several components:

Energy – the actual electricity consumed.

Capacity – charges paid to ensure enough electricity is available on the grid during periods of peak demand (e.g., the hottest summer day).

Transmission – fees for moving electricity from power plants to your utility.

Ancillary services – reliability services like voltage support or frequency regulation.

CPA members have fixed-rate contracts through third-party suppliers that include all the components above bundled into one reliable rate.

But recent years have seen volatility and uncertainty around sudden regulatory or market changes—the most recent of which has affected the capacity portion of supply costs.

So What Changed? PJM’s Capacity Auctions Drove a Massive Price Spike

Electricity grid reliability in our region is managed by PJM, a regional transmission organization (RTO) that covers 13 states and DC. Each year, PJM runs a capacity auction to ensure enough power will be available during future peak demand events. These auctions determine the capacity portion of your supply rate, and were meant to offer predictability with rates set 2–3 years in advance.

In 2024, big changes took place.

PJM implemented sweeping reforms to how it models grid reliability and evaluates power generation resources. These reforms were approved by the Federal Energy Regulatory Commission (FERC) and included:

More rigorous modeling of grid stress during all 8,760 hours of the year (not just peak summer hours) to account for growing risk from extreme weather events.

A new accreditation system that reduced the reliability value of intermittent sources like wind and solar, which don’t run 24/7.

A rule allowing some utilities to re-enter the auction process early, increasing market unpredictability.

These changes tightened the balance between supply and demand in PJM’s auction system, triggering a historic spike in prices.

PEPCO capacity clearing prices jumped from $49.68 to $270.35 per MW-day.

Dominion saw an increase from $28.99 to $429.57 per MW-day.

The regional clearing price rose nearly ninefold, from $28.92 to $269.92.

This was no incremental bump—it was a structural reset that affected all electricity users, regardless of utility or supplier.

The Impact: Nonprofits Caught in the Middle of a Market Shift

Over the past decade, CPA has analyzed hundreds of electric bills and energy supply contracts. We’ve seen how the term “fixed rate” can mean very different things depending on the supplier.

Some so-called “fixed” rates pass through key cost components like capacity entirely. Others include them in their fixed rate—until there's a regulatory shift.

Every supply contract includes a “Change in Law” clause, which allows suppliers to pass through certain costs in the event of regulatory changes. Because PJM’s capacity reforms were approved by FERC, suppliers across the industry—our own included—invoked this clause to pass through some or all of the increased capacity cost beginning June 2025.

At the same time, utilities like Pepco increased their default rates by similar amounts—up to 25%—as they, too, adjusted for the new capacity charges.

Regulatory push-back and market volatility continues to fuel uncertainty around how capacity rates will impact energy prices into the future. CPA works closely with suppliers to understand what is included in their pricing and to ensure that we get fixed rates on all components possible.

How the Co-op Responded: Education, Advocacy, and Collective Decision-Making

This moment is exactly why CPA exists.

Our role isn’t just to negotiate energy contracts and secure competitive rates. It’s to provide trusted information and collective decision-making support when the market shifts.

Here’s how we responded:

We Created a Shared Space to Learn and Plan

Held one-on-one meetings, small-group discussions, and a large group webinar in May 2025 with all impacted members.

Provided plain-language briefings about what capacity costs are, why they were going up, and how the new charges would appear on bills.

Shared a comparative analysis of supplier vs. utility rates so members could assess the relative impact on their organization.

We Secured Legal and Financial Reviews

Retained legal counsel to review the legitimacy of the “Change in Law” clause and its use in this situation.

Confirmed that our suppliers’ pass-through was legally permissible under the contract terms.

Analyzed historical usage data and projected individual financial impacts for each member.

We Explored Supplier Mitigation Options

Our main supplier offered a “mitigation” option: organizations who renewed their contract for an additional 3 years at a new rate could avoid the Change in Law charges in their current contract. In essence, the additional capacity costs would be spread over a future term rather than show up immediately on bills starting in June 2025.

CPA helped members:

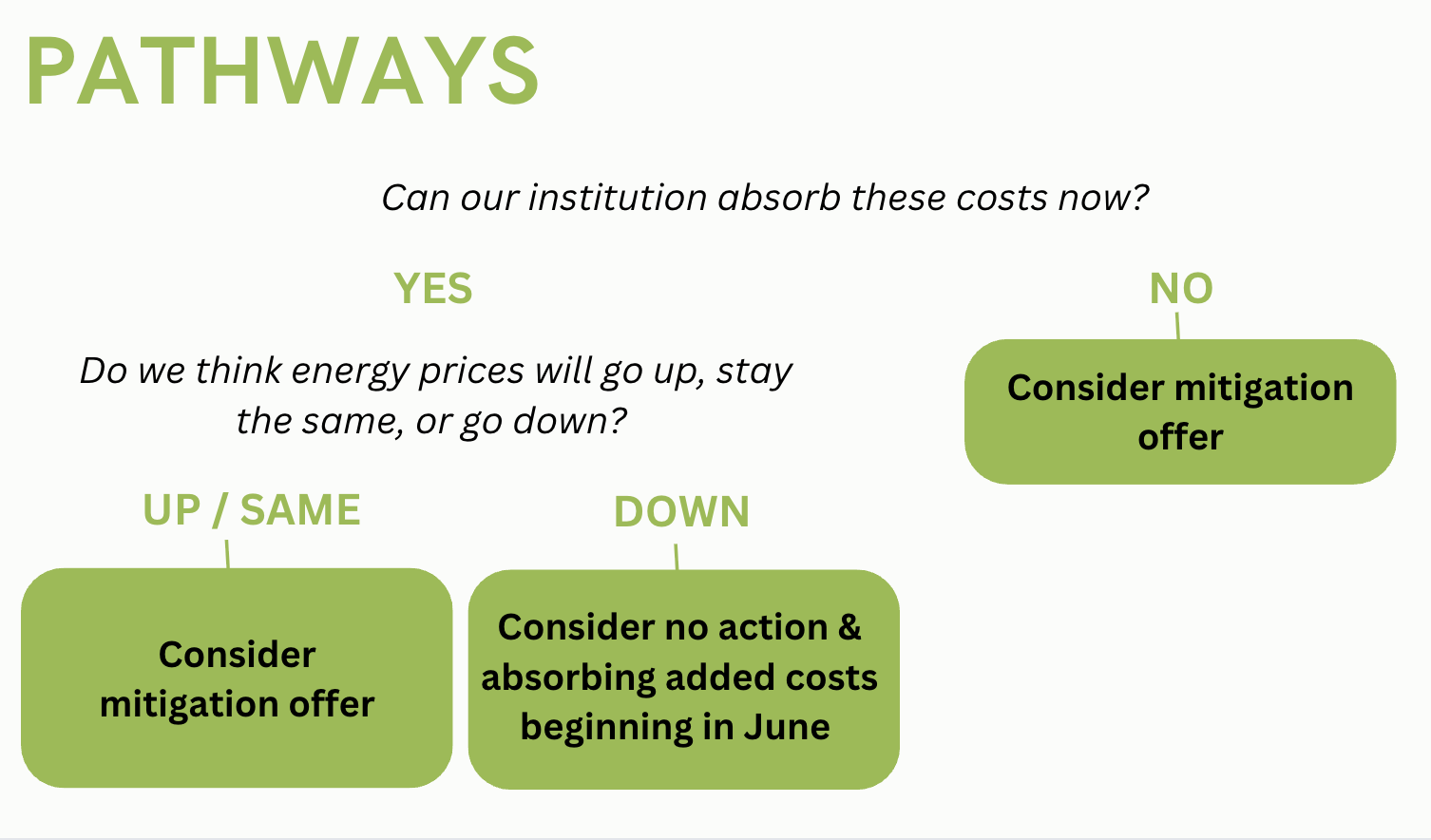

Understand the financial trade-offs of absorbing costs now versus deferring them.

Review projected renewal rates and determine alignment with future budgets.

Assess whether their organization could absorb these increases now or needed to explore relief options.

The Decisions Members Made: Different Paths, Shared Strategy

Ultimately, each organization had to make the decision that worked best for their context—based on their budget flexibility, risk tolerance, and outlook on future energy markets.

Some members absorbed the added cost, preserving flexibility to seek new rates when their contract ends in 2026 or 2027.

Others accepted the mitigation offer, extending their contracts to avoid near-term budget disruption. They saw value in locking in a known, albeit higher, blended rate for the long haul—especially if they anticipated further increases in market rates.

And many others used this moment to reassess their long-term energy strategy—some exploring solar, energy efficiency projects, or demand-side management programs to lower their capacity exposure in future auctions.

Regardless of the path chosen, every member had access to individualized projections, expert counsel, and the support of peers making the same hard calls.

What We Learned—and What Comes Next

This experience underscored what CPA has always believed: when institutions come together, they’re stronger and better informed.

Here are a few lessons we’re carrying forward:

Capacity markets are volatile and the future is uncertain. The growing demand from data centers and AI infrastructure is outpacing supply in some regions. Future auctions may see continued reforms, delays, or even legal challenges.

Carefully vetted fixed-rate contracts are still powerful–but aren’t bulletproof. Even with Change in Law adjustments, CPA-negotiated contracts offered significant savings over utility default rates.

The value of the co-op goes far beyond price. Collective decision-making, peer learning, and trusted information helped organizations respond with clarity and act nimbly in complex markets.

Looking ahead, we’re already preparing for the next electricity group purchase. We'll continue to monitor regulatory changes, capacity auction results, and market trends—and we’ll bring those insights back to the CPA community.

We’re also exploring:

Energy efficiency and demand response strategies that reduce future capacity costs.

Member-led learning groups to explore long-term sustainability options.

Final Thoughts: In Uncertainty, Community Is Power

While no one could have predicted this year’s capacity price spike, we’re proud of how our members responded—not in panic, but with collective insight and calm decision-making.

As our Energy Program Director noted on our May 15 group call:

“I think issues like this are the reason that the co-op exists so you're not having to make sense of what's going on alone… you're able to come to a group space like this and really talk it out.”

If your organization isn’t yet part of CPA’s electricity program—or if you want to be included in the next group purchase—now is the time to reach out. We'll help you understand your current options, review your contract status, and plan for the future.

Because navigating complexity is easier when you don’t do it alone.